International Monetary Cooperation: Lessons from the Plaza Accord after Thirty Years

Takatoshi Ito

Professor of International and Public Affairs

Personal Details

Focus areas: International finance, Japanese economy, Asian financial markets, monetary policy

Takatoshi Ito joined the faculty of SIPA as a Professor of International and Public Affairs in January 2015. An internationally renowned economist, Ito is an expert on international finance, macroeconomics, and the Japanese economy who served from 2006 to 2008 as a member of the Prime Minister’s Council on Economic and Fiscal Policy. He also held senior positions in the Japanese Ministry of Finance and at the International Monetary Fund. Ito served as Dean of the University of Tokyo’s Graduate School of Public Policy for the past two years and as professor at Japan’s National Graduate Institute for Policy Studies. He has served as a visiting professor at both Columbia and Harvard and taught at other institutions. He earned his PhD in economics at Harvard University.

Ito has had distinguished academic and research appointments such as President of the Japanese Economic Association in 2004; fellow of the Econometric Society since 1992; research associate at the National Bureau of Economic Research since 1985; and faculty fellow at the Centre for Economic Policy Research since 2006. He was editor-in-chief of Journal of the Japanese and International Economies, and is co-editor of Asian Economic Policy Review. In an unusual move for a Japanese academic, Ito was also appointed in the official sectors, as senior advisor in the Research Department, International Monetary Fund (1994–97) and as deputy vice minister for international affairs at the Ministry of Finance, Japan (1999–2001). He served as a member of the Prime Minister’s Council on Economic and Fiscal Policy (2006–2008). In 2010, he was a co-author of a commissioned study of the Bank of Thailand’s 10th year review of its inflation targeting regime. He frequently contributes op-ed columns and articles to the Financial Times and Nihon Keizai Shinbun.

He is an author of many books including The Japanese Economy (MIT Press, 1992), The Political Economy of the Japanese Monetary Policy (1997) and Financial Policy and Central Banking in Japan, with T. Cargill and M. Hutchison, (MIT Press, 2000), An Independent and Accountable IMF, with J. De Gregorio, B. Eichengreen, and C. Wyplosz (1999). He is also the author of more than 130 academic (refereed) journal articles in journals such as Econometrica, American Economic Review, and Journal of Monetary Economics and chapters in books on international finance, monetary policy, and the Japanese economy. His research interests includes capital flows and currency crises, microstructures of foreign exchange rates, and inflation targeting. He was awarded the National Medal with Purple Ribbon in June 2011 for his excellent academic achievement.

Education

- PhD in Economics, Harvard University

- MA in Economics, Harvard University

- MA in Economics, Hitotsubashi University

- BA in Economics, Hitotsubashi University

Honors and Awards

- The (Emperor’s) Medal with Purple Ribbon for exceptional academic achievement, 2011

- Honorary Doctorate (Doctor Honoris Causa) University of Chile, 2015

Research And Publications

Asian Development Review

Supervision and Regulation: Effects of Global Financial Crisis on Japan and Asia

The Future of Large, Internationally Active Banks (World Scientific)

Journal of the Japanese and International Economies

In The Media

Takatoshi Ito wrote: “Unless policymakers embrace far-reaching productivity-enhancing reforms, the country’s global position will continue to decline.”

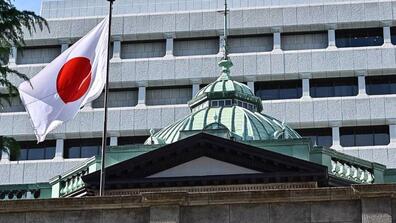

Takatoshi Ito writes that markets seem to be expecting the Bank of Japan to initiate monetary-policy normalization relatively soon, with interest-rate hikes most likely beginning in April.

The Bank of Japan's shock move to widen the bond yield band is a “positive development” that would improve the functionality of the Japanese government bond market, says Takatoshi Ito.

Professor Takatoshi Ito says the central bank views wage hikes as key to reaching its “sustainable 2% target” for inflation.

Professor Takatoshi Ito writes that by prioritizing security and stability over economic dynamism, China’s leaders are abandoning some of the policies and principles that underpinned the country’s “economic miracle.” Unless they change course, the entire global economy will suffer.